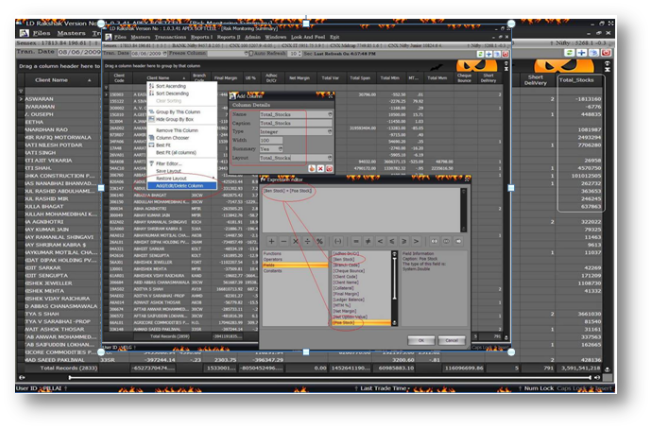

Own Formula Setup

An option to add a new column and setup user’s own formula. This helps in creating

user defined risk report.

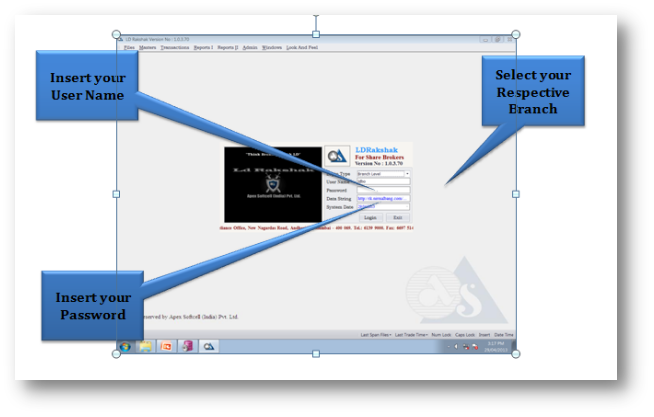

Some Reports Available in LD-Rakshak Login Screen

A User has to select the Firm & give the user Name & Password to proceed.

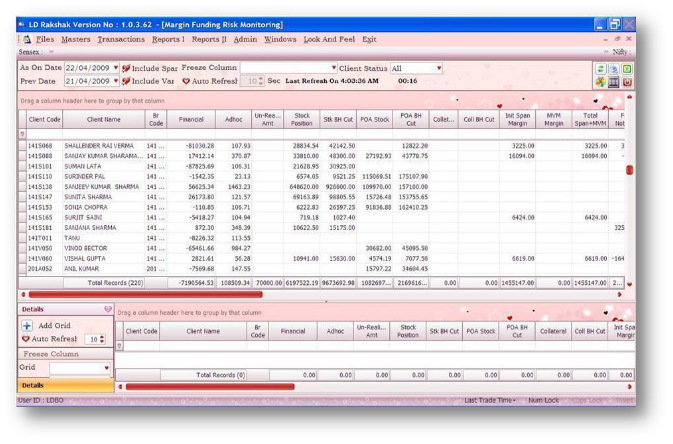

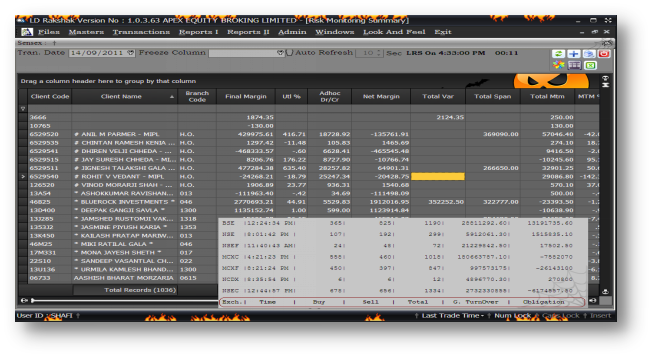

Risk Monitoring Report

LD Rakshak generates Risk monitoring report in live during market hour. User

would come to know in this report the total risk which is involved in financing

each and every client and would be in position to take appropriate action.

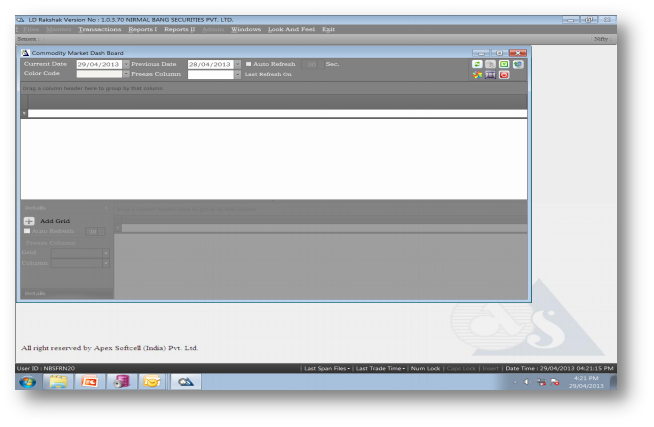

Commodity Market Dash Board

User can view Client wise commodity Position including his MTM, SPAN Margin, Net

Dr. Cr. and guide their client to take a call on the same.

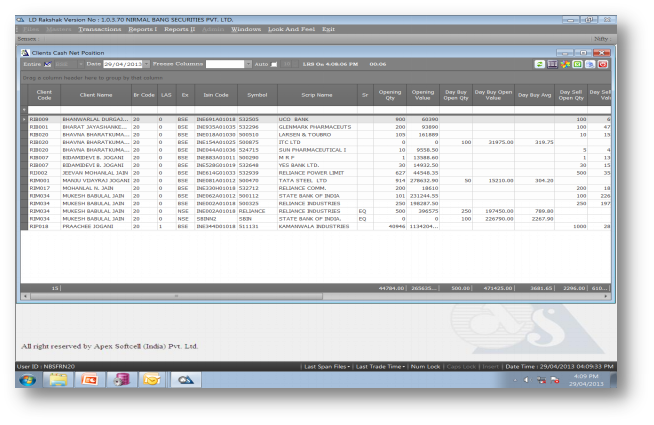

Client’s Cash Net Position

User can view Client wise cash net Position including his opening stock details.

Market Watch Statistics

User can view Position of Cash, Currency and Derivatives segment for Client wise,

Branch Wise and Scrip Wise of Current Day’s or Selected criteria.

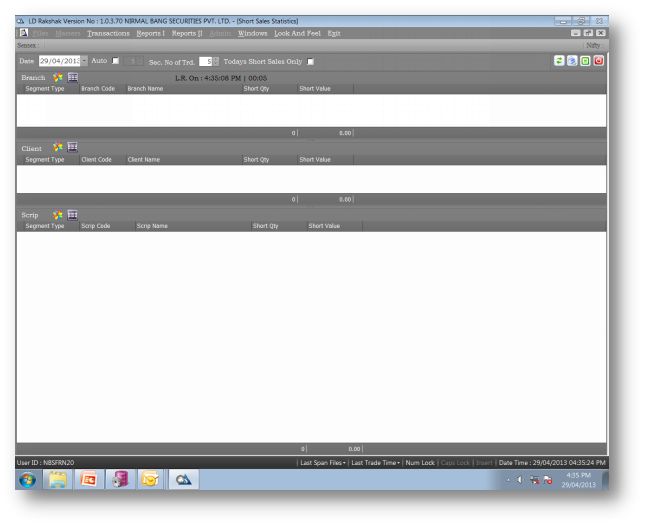

Short Sales Statistics

User can view Only Short Sale Client’s Positions of Cash, Currency and Derivatives

segment for Client wise, Branch Wise and Scrip Wise of Current Day’s or Selected

criteria.

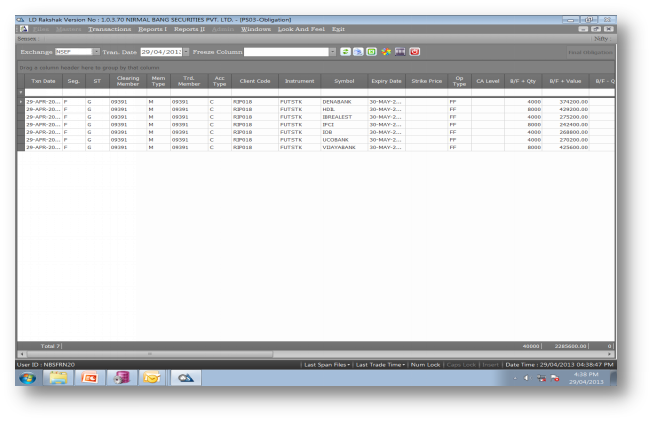

PS03 Position File

User can view his client’s position of all Derivatives segment , Exchange wise,

including his M2M and obligations.

Client Turnover

User can view Client wise Turnover Reports as per selected Criteria.

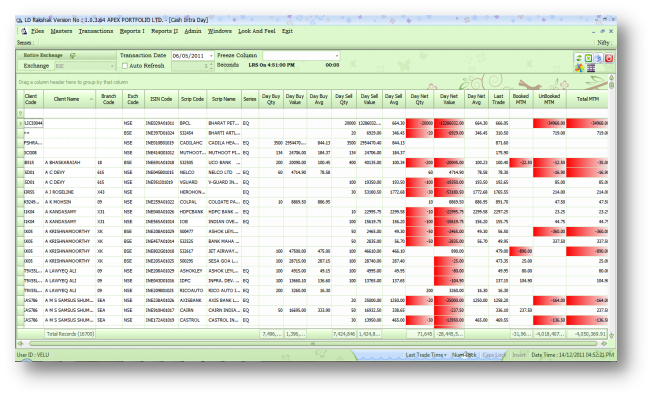

Cash Intra Day Position

User can monitor live MTM in case of Cash segment where booked MTM and un- booked

MTM is clearly visible.

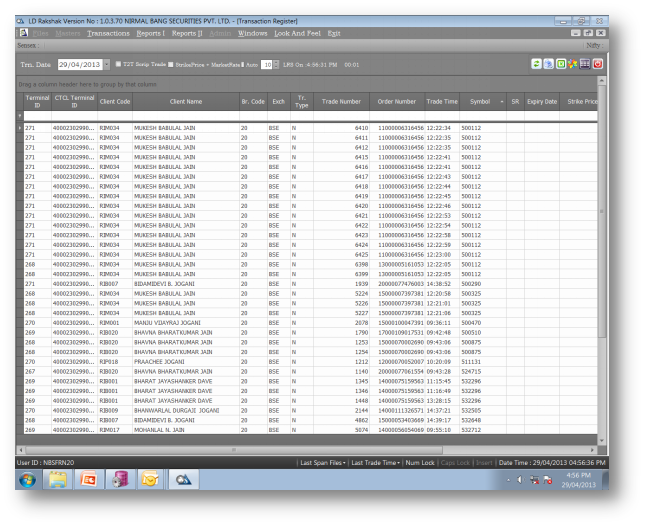

Transaction Register

User can view his client’s transaction Register of all segment as per selected criteria.

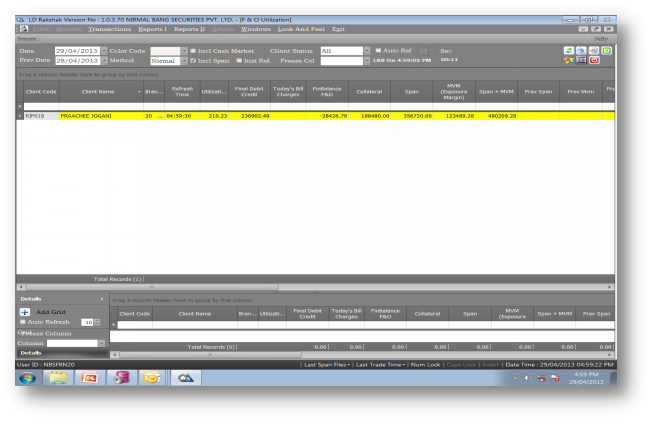

FO Utilization

User can view his client’s FO Utilization of all Derivatives segment including M2M,

Collateral, SPAN, and Net Dr. Cr. as per selected criteria.

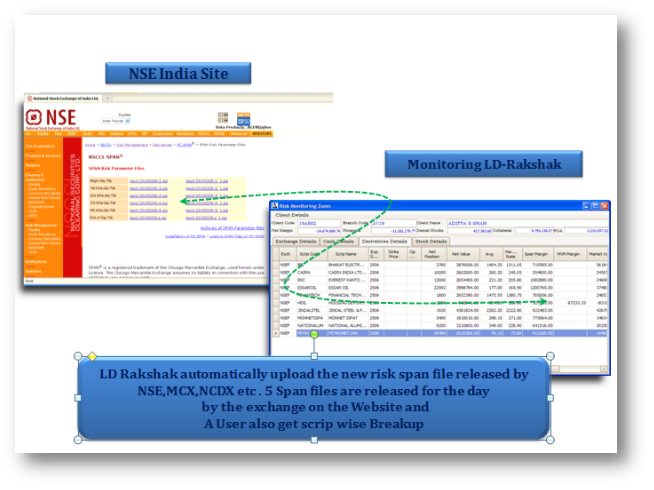

SPAN Margin Comparison

User can compare his client’s SPAN Margin with previous day’s SPAN Margin.

Option M2M

User can view his client’s only option position’s M2M details for currency and Derivative

Segment.

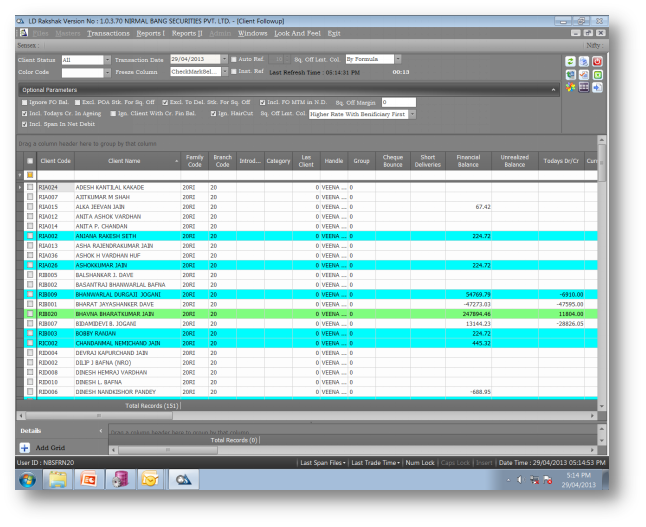

Client Follow up

User can view LIVE his client’s follow up report which is sent by RMS department

on daily basis.

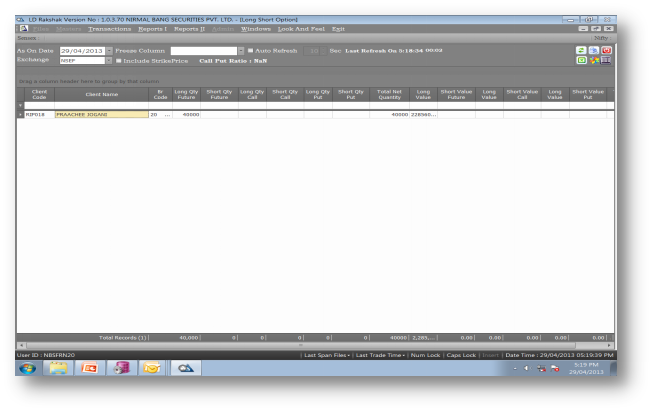

Long Short Positions

User can view his client’s Long and Short positions in ALL derivative segment as

per selected criteria.

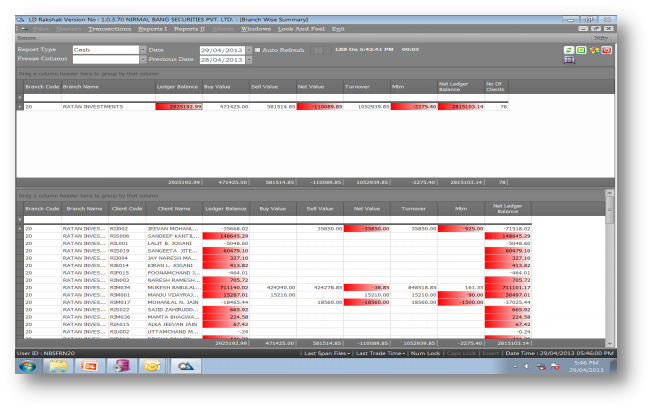

Branch Wise Summary

User can view Branch / Franchisee wise summary including M2M and Ledger and also

can view client wise position as per selected criteria.

Limit Update to CTCL Software

An option to update Limit to CTCL Software of user’s choice. The branch request

for extra limit for a particular client. The RMC person at H.O. approves or disapproves

the limit. The Limit once approved / disapproved goes to the CTCL Admin Server and

a secondary message goes to the branch.

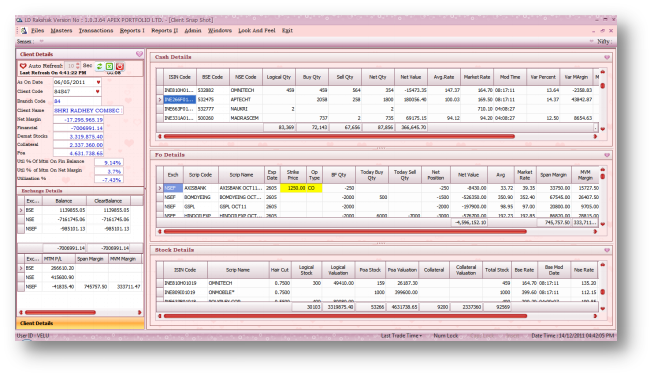

Client Snap Shot link with LD Client Level Software

As LD-Rakshak software is linked with LD Client Level Software. The client when

he logs in during market hours would be able to view his position across finance

/ cash market / derivatives market with current span margin information. This would

be very useful to all clients as they can also see up-to-date portfolio position

and mark to market position and their margin position.

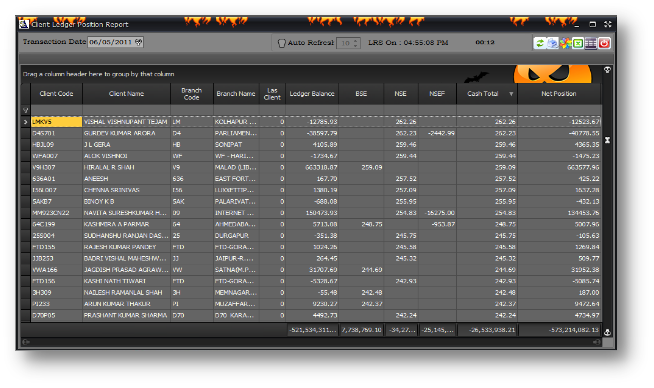

Live Ledger Position

User can view Live Ledger Position + Forthcoming Dr/Cr during live Market hours.

In LD-Rakshak Notional Bill of all exchange is prepared every second and the RMS

in-charge is informed about the forthcoming debit / credit per trade basis without

processing anything. Also user can view LAS Client details.

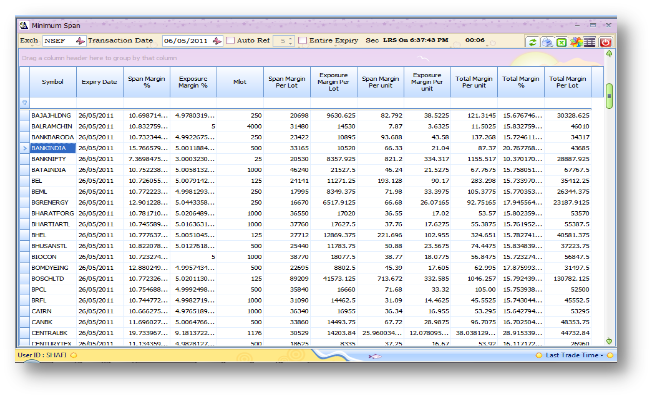

Minimum Span

User can view Live Span and Exposure margin for a single lot so that user will come

to know that margin to be collected from a client.

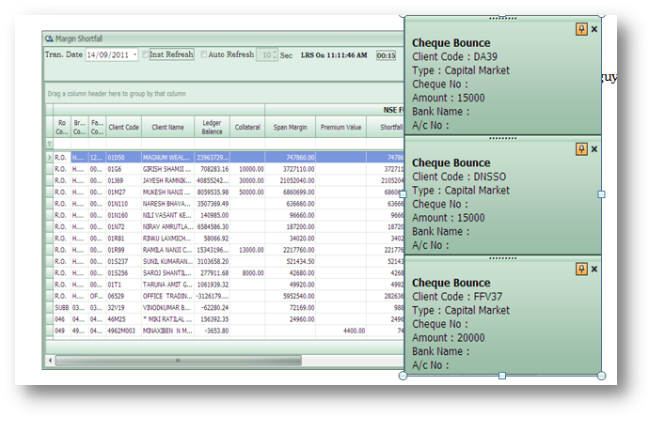

Margin Shortfall Penalty

LD-Rakshak would gives user live report as and when the trade takes place as to

the total amount of penalty that would be levied as per the position taken. A sample

report is attached for your reference. The system would also be geared up to send

sms at regular interval to client as to the penalty that they have to bear for the

same.

Scrip Client Circuit Information

User can view Client wise scrip wise Circuit details. This will help the user to

know which scrip is near to the Upper/Lower Circuit. And guide their client to take

a call on the same.

Client Scrip net position

User can view Client wise scrip wise Net Position for his Entire Clients. This will

help the user to know MTM and upcoming Dr./ Cr. details of Every Clients on his

outstanding Positions and guide their client to take a call on the same.

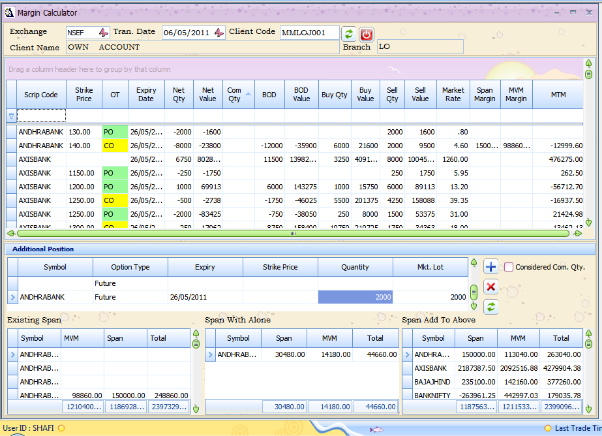

Margin Calculator

User can view Current span margin and exposure margin for multiple scrips with Existing

span, Span with alone (New span) and Span add to Above (Existing plus new position).

A complete SPAN Calculator is in-build.

Client Pure Risk

The client’s actual risk is displayed in this report. The Pure risk / net available

details along with projected risk is displayed.

Broadcast in LD-Rakshak

For Span margin shortfall the system would send sms to the client every x minute

automatically. You need not send the same manually.

You can configure the broadcast server to automatically send a sms to the registered

mobile phones regarding the current exchange obligation / span margin utilization

etc.

The moment a cheque bounces all the RMS guys would receive a alert for the client.

Last Traded Time

Each LD-Rakshak Screen displays on the bottom the last trade time, Buy/Sell Trades,

Turnover and Obligation uploaded into the LD-Rakshak. If you notice the moment the

file is delivered by the respective exchanges it takes max 1-2 seconds to import

into LD-Rakshak and most importantly any report in LD-Rakshak after various calculations

is around 6-7 seconds behind. You have to set up the report for background refresh.

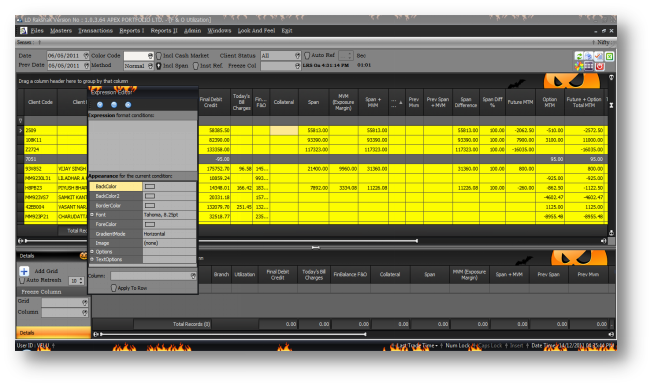

Option To Setup Your Own Editor For Each Fields

Option to setup user’s own editor for each fields i.e. if a particular condition

is met then the same should be shown in Red colour , if a particular condition is

met then the same should be made bold, if a particular condition is met then the

same should be made italic.

Look and Feel

User can change the look and feel according to his / her preference by selecting

any of the options given below.

Key Features Of LD RAKSHAK

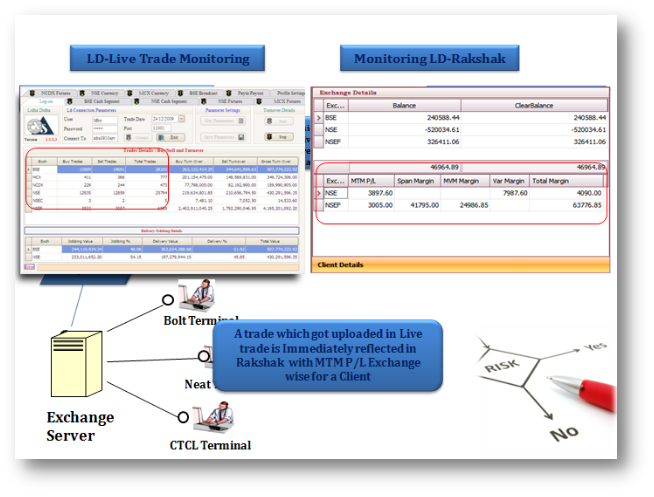

LD RAKSHAK:Live Connected to Back-office Software so no Batch file import

& export is required. Data follows time to time from back-office and it is also

connected to LIVE trades. No gap for error.

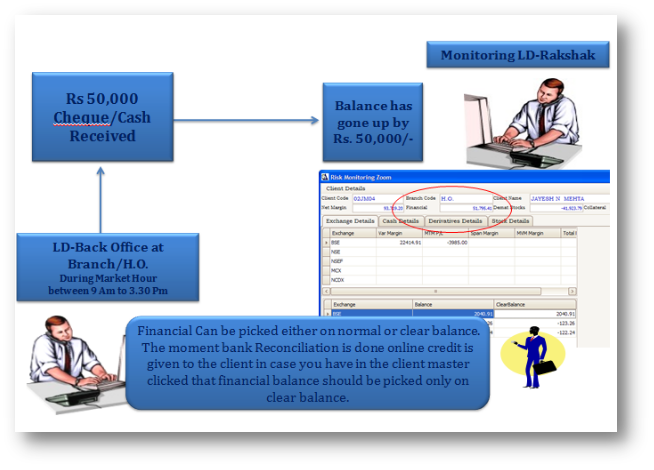

As the software talk’s Live with LD Back-office the other advantage we get are:

Changes like cash-bank addition, Modification, deletions all gets effected as and

when it happened. Where in other software there is no way to do this they have to

calculate figure on the base of the Batch file they got in the morning.

Changes in Stock, i.e. some one has run Beneficiary to Pool-Client, client to Beneficiary,

Pay in-Payout hitting the data such Debit & Credit of stock are not reflected

in other software but YES in our LD RK it pickup such information on a real time

bases.

There can be collaterals stock movement or stock value is moving up or down happing

after the batch file is upload in other RMS software which are computed manually.But

here in our RK this is also computed on the real time base.

Bank Reconciliation: any amount clear after the batch upload in other RMS software

has to maintain manually. But in LD RK such credit are automatically allocated to

client.

All the above details helps the Broker to give more exposure to his customers !!

Now this is what we say is LIVE and REAL time risk monitoring software !!

**Get real and change your working to change your life !!! **